First and foremost, outsourcing payroll eliminates costly penalties for inaccurate calculation or untimely reporting of payroll taxes. It allows the business to forego costly system upgrades to keep payroll tax tables updated, and eliminates the need to maintain a separate bank account for your payroll activity. Outsourcing payroll makes bank reconciliations easier. Kemper 1st Choice Payroll services exist within a secure environment and allow you to utilize paperless processes, encrypted data and storage functionality without large capital investments.

We strive to deliver the highest level of service we refer to as “White Glove” Delivery of Service. To demonstrate a few ways we achieve the White Glove status, below is how we respond to some frequently asked questions from employers considering engaging Kemper 1st Choice Payroll.

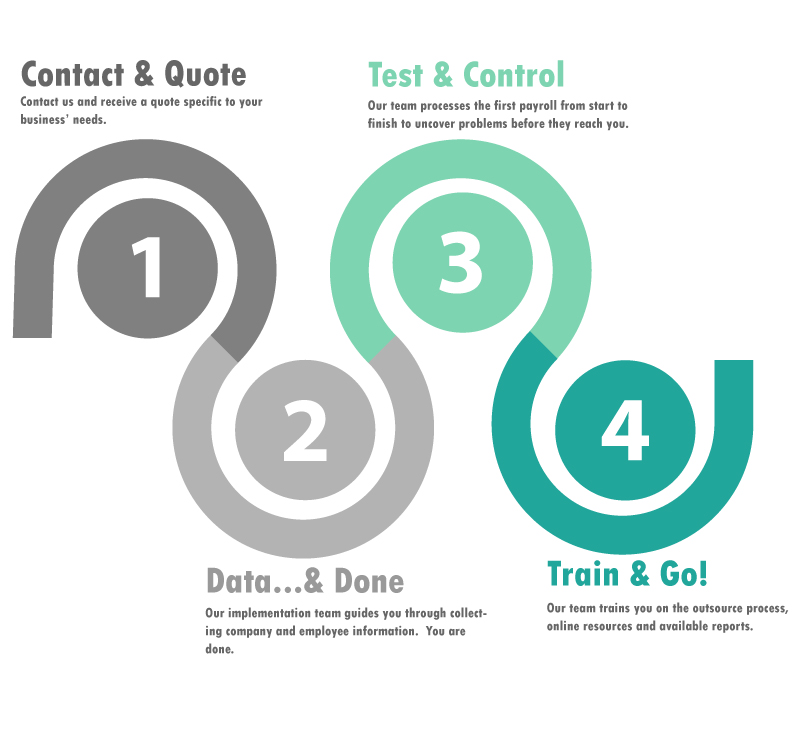

What is the general process to outsource my payroll?

How will my calls be answered?

There are no call center protocols, ticket numbers, and long hold times. Your incoming call is answered by our receptionists who will ensure you get to the appropriate member of our staff. But this human to human interaction is only the beginning…

Who will answer my questions?

The foundation of our White Glove Services is built upon our experienced Account Representatives. As a client, you are assigned an Account Representative. This person manages every aspect of your account from processing payroll to uploading your employees’ retirement plan contributions to paying child support payments online. You will have their name, phone extension and email to use when you have questions. Your Account Representative is your valued resource. They are available, responsive, and diligent.

If I want to use your payroll services, what do I need to do?

Your decision to engage Kemper 1st Choice Payroll initiates the involvement of our Implementation & Training Team. This team includes payroll and human resource professionals responsible for completing each task within the implementation process. Your preliminary involvement includes gathering the requested information and submitting it to the Implementation Team within the pre-determined deadlines.

Upon the receipt of all requested information, this team begins building the information within our system platform. This team methodically tests and reviews outcomes throughout the implementation process to ensure accuracy.

Will I receive training?

Yes. For continuity, the same team assigned to complete the implementation coordinates and conducts training to you, especially if you are utilizing our online solutions. You can expect the training tailored to your company’s specific needs. Our training includes several short sessions to maximize learning and minimize any anxiety while learning something new. This team does a lot of hand-holding until all components of the engagement are running smoothly so the transition to your Account Representative is as seamless as possible.

In addition, if your company meets the FTE threshold within the Affordable Care Act (ACA), you can choose additional training for the integrated ACA module which meets the reporting requirements with the Employer Mandate which currently remains in effect.

What resources are available to me?

Outside of your assigned Account Representative, you will have access to a diverse group of professionals. Within Kemper 1st Choice Payroll, we have a Certified Payroll Professional (CPP), Senior Profession Human Resource (SPHR-SCP), and a multi-state Payroll Tax Specialist.

As a division of Kemper CPA Group, we have access to CPAs, TPAs, and Certified Bookkeepers (CB) who also hold QuickBooks ProAdvisor Certifications. In addition, Kemper Technology Consultants have technologists who specializes in IT infrastructure, software, programming, and web design.